BetX Registration - Join Global Betting Excellence

Professional Multi-Tier Account Opening for Global Market Access

Join over 10 million professionals worldwide who trust BetX for their betting and trading activities. Our comprehensive registration system accommodates everyone from retail clients to institutional traders through five distinct service tiers, each designed to meet specific professional requirements and regulatory compliance standards.

Experience seamless betx register online process with institutional-grade verification, multi-jurisdictional compliance, and personalized onboarding tailored to your professional needs and trading objectives.

Multi-Tier Registration System

Level 1 - Retail Client Account

Standard Professional Service: Entry-level professional account suitable for individual traders and betting enthusiasts seeking reliable platform access with essential features.

Account Features:

- Verification Requirements: Email and phone verification only

- Monthly Limits: Up to $10,000 transaction volume

- Market Access: Core sports and casino markets

- Support Level: Professional email support during business hours

- Odds Structure: Standard competitive odds across all markets

- Processing Time: Immediate activation upon basic verification

Level 2 - Verified Professional Account

Enhanced Service Level: Comprehensive verification unlocks increased limits and enhanced features for serious bettors and regular platform users.

Enhanced Features:

- KYC Documentation: Government ID and proof of address required

- Monthly Limits: Increased to $50,000 transaction capacity

- Extended Markets: Access to specialized and niche betting markets

- Support Upgrade: Phone and live chat support availability

- Odds Enhancement: 5% improvement on standard odds across major markets

- Processing Time: 24-48 hours for full verification and activation

Level 3 - Premium Member Status

Advanced Professional Platform: Premium tier for serious traders requiring enhanced limits, exclusive markets, and personalized service delivery.

Premium Benefits:

- Enhanced Due Diligence: Comprehensive background and financial verification

- High Limits: Up to $250,000 monthly transaction capability

- Exclusive Markets: Access to private betting lines and exclusive opportunities

- Personal Management: Dedicated account manager assignment

- Premium Odds: 10% enhancement over standard market odds

- Processing Time: 3-5 business days for complete verification

Level 4 - VIP Client Services

Elite Trading Environment: VIP status for high-net-worth individuals and professional traders requiring unlimited access and premium service levels.

VIP Privileges:

- Comprehensive Verification: Full background check and enhanced due diligence

- Unlimited Limits: No restrictions on transaction volumes or bet sizes

- Private Lines: Exclusive access to private betting lines and markets

- 24/7 Support: Dedicated support team available around the clock

- Best Odds Guarantee: Guaranteed access to best available odds in market

- Processing Time: 5-7 business days with white-glove verification process

Level 5 - Institutional Services

Corporate and Institutional Access: Specialized services for corporations, institutions, and high-volume professional trading operations.

Institutional Features:

- Corporate Compliance: Full corporate verification and compliance documentation

- Multi-Million Limits: Customized limits based on institutional requirements

- API Trading Access: Direct API access for automated trading systems

- Dedicated Infrastructure: Reserved server capacity and priority processing

- Institutional Pricing: Customized pricing structures and fee arrangements

- Processing Time: 10-15 business days with comprehensive corporate verification

Comprehensive Registration Process

Step 1: Basic Information Collection

Professional Data Requirements: Initial registration captures essential information required for account categorization and preliminary compliance screening.

Required Information:

- Full Legal Name: Exactly as appears on government-issued identification

- Professional Email: Corporate email addresses preferred for business accounts

- International Phone: Mobile number with international country code

- Date of Birth: Age verification for legal gambling compliance

- Citizenship and Residency: Tax and regulatory jurisdiction determination

Step 2: Jurisdictional and Currency Selection

Global Compliance Configuration: Betx register mobile and desktop platforms accommodate global diversity through comprehensive localization and compliance adaptation.

Configuration Options:

- Registration Jurisdiction: Selection from 25+ available regulatory jurisdictions

- Preferred Currency: Choice from 40+ fiat currencies and 15+ cryptocurrencies

- Compliance Framework: Automatic application of relevant regulatory requirements

- Tax Residence: Declaration for international tax compliance

- Regulatory Acknowledgments: Jurisdiction-specific legal acknowledgments and consents

Step 3: Financial Profile Assessment

Professional Financial Evaluation: Comprehensive financial assessment ensuring appropriate service level assignment and compliance with anti-money laundering regulations.

Assessment Components:

- Source of Funds: Detailed declaration of funding sources and origins

- Transaction Expectations: Projected monthly and annual transaction volumes

- Banking Relationships: Primary banking institutions and financial relationships

- Investment Experience: Professional trading and investment background

- Risk Tolerance: Comprehensive risk assessment and profile determination

Step 4: Document Verification Process

Institutional-Grade Verification: Professional document verification system utilizing advanced AI technology and human review for accurate identity confirmation.

Required Documentation:

- Government ID: Passport, national ID, or driver's license

- Address Verification: Utility bill, bank statement, or official correspondence

- Financial Documentation: Bank statements or financial institution letters

- Corporate Documents: Articles of incorporation and corporate resolutions (if applicable)

- Additional Compliance: Supplementary documentation based on jurisdiction and account level

Step 5: Account Activation and Configuration

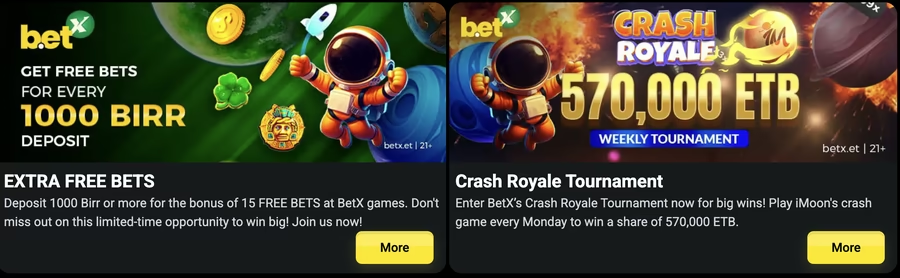

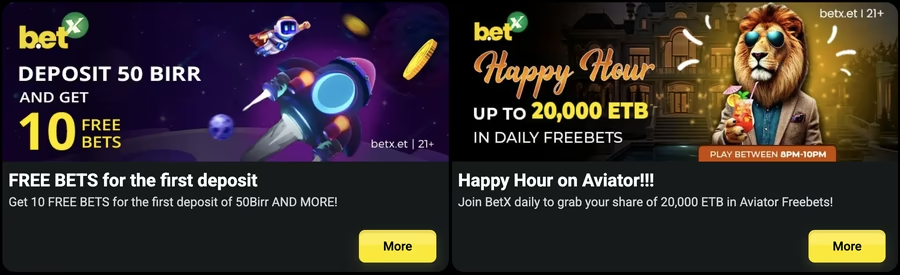

Personalized Account Setup: Final activation process includes personalized configuration and welcome package assignment based on selected service tier.

Activation Process:

- Welcome Package: Tier-appropriate bonuses and promotional offers

- Limit Configuration: Account limits set according to verification level

- Market Preferences: Preferred sports, markets, and betting options setup

- Communication Settings: Notification preferences and contact methods

- Deposit Incentives: First deposit bonuses and promotional credits

International Compliance Framework

Anti-Money Laundering (AML) Compliance

Global AML Standards: Comprehensive anti-money laundering procedures meeting international standards across all operating jurisdictions.

AML Procedures:

- Customer Due Diligence (CDD): Standard verification for all account levels

- Enhanced Due Diligence (EDD): Additional scrutiny for VIP and institutional accounts

- Ongoing Monitoring: Continuous transaction monitoring and pattern analysis

- Suspicious Activity Reporting: Automated detection and reporting systems

- Sanctions Screening: Real-time screening against international sanctions lists

Know Your Customer (KYC) Implementation

Professional Identity Verification: Multi-layer identity verification system ensuring compliance with international KYC standards while maintaining user privacy.

KYC Components:

- Identity Verification: Government document authentication and validation

- Address Verification: Residence confirmation through multiple document types

- Source of Funds: Financial background verification and documentation

- Enhanced Verification: Additional scrutiny for high-risk accounts and jurisdictions

- Periodic Review: Regular account review and update procedures

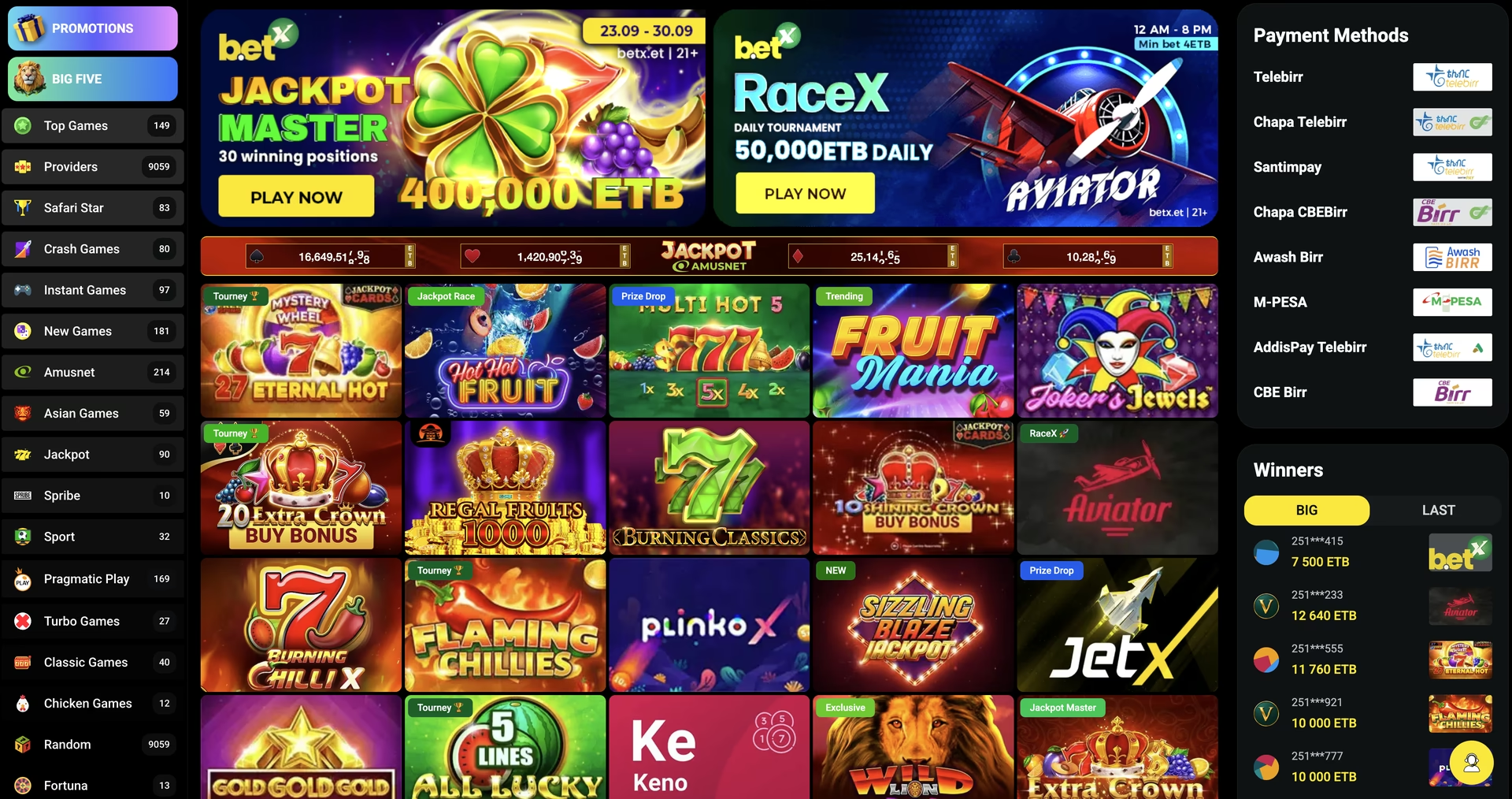

Ethiopian Market Specialization

Local Document Support

Ethiopian-Specific Verification: Comprehensive support for Ethiopian identification documents and local verification requirements.

Accepted Documents:

- Ethiopian National ID: Primary identification document with enhanced verification

- Ethiopian Passport: International passport with diplomatic recognition

- Utility Bills: Accepted in Amharic and English languages

- Bank Statements: Ethiopian banking institutions including CBE, Dashen, Awash

- Employment Verification: Ethiopian employer verification letters and documentation

Ethiopian Financial Integration

Local Banking and Payment Support: Complete integration with Ethiopian financial infrastructure and mobile payment systems.

Financial Requirements:

- Minimum Deposit: 500 ETB for account activation

- Local Currency: Full Ethiopian Birr support without conversion fees

- Banking Preference: Ethiopian bank accounts preferred for verification

- Mobile Money: Telebirr verification and transaction support

- Tax Compliance: Ethiopian tax declaration and compliance documentation

Cultural Adaptation Services

Ethiopian Market Integration: Comprehensive cultural adaptation ensuring comfortable and appropriate service delivery for Ethiopian clients.

Cultural Features:

- Amharic Language: Full customer service and interface support

- Ethiopian Calendar: 13-month calendar system integration and compatibility

- Holiday Considerations: Recognition and respect for Ethiopian holidays and traditions

- Cultural Training: Staff cultural sensitivity training for Ethiopian customs

- Community Engagement: Active participation in Ethiopian community initiatives

Technology and Security Infrastructure

Digital Onboarding Excellence

AI-Powered Verification: Advanced artificial intelligence systems streamline document verification while maintaining security and accuracy standards.

Technology Features:

- Document Recognition: Automated ID document scanning and data extraction

- Real-Time Verification: Instant identity checking against government databases

- Compliance Automation: Automated screening and compliance checking systems

- Digital Signatures: Legally binding electronic signature acceptance

- Mobile Optimization: Complete mobile-first registration experience

Enterprise Security Measures

Bank-Grade Protection: Military-grade security protocols protecting sensitive registration data and personal information throughout the onboarding process.

Security Implementation:

- End-to-End Encryption: All data transmission protected by advanced encryption

- Secure Storage: Encrypted document storage with restricted access controls

- Privacy Design: Privacy-by-design principles throughout registration process

- GDPR Compliance: Full European data protection regulation compliance

- Retention Policies: Configurable data retention meeting regulatory requirements

Post-Registration Experience

Professional Welcome Journey

Personalized Onboarding: Comprehensive welcome experience tailored to account tier and professional requirements.

Welcome Components:

- Personal Greeting: Customized welcome message from account management team

- Platform Tutorial: Guided tour of features relevant to account level

- Feature Introduction: Detailed explanation of available tools and services

- Manager Assignment: Introduction to personal account manager (Premium+)

- Bonus Activation: Welcome package activation and bonus credit processing

Ongoing Professional Development

Continuous Education and Support: Professional development resources and ongoing support ensuring optimal platform utilization.

Development Resources:

- Strategy Guides: Professional betting and trading strategy documentation

- Platform Training: Advanced feature tutorials and best practices

- Market Education: Comprehensive market analysis and betting education

- Risk Management: Professional risk management training and tools

- Compliance Updates: Regular updates on regulatory changes and requirements

Ready to join the global community of professional bettors and traders? Start your betx register process today and gain access to institutional-grade betting services trusted by millions worldwide.